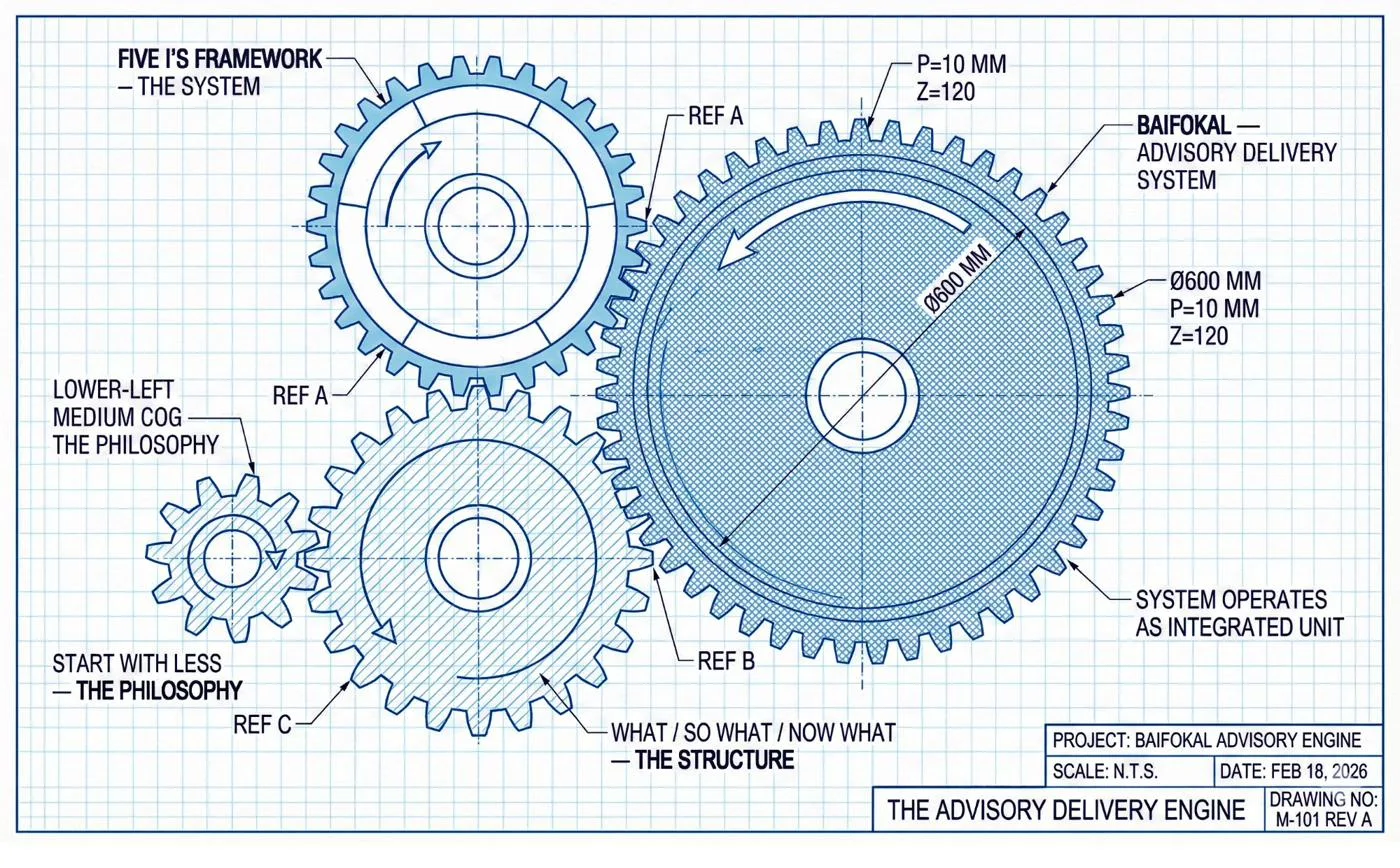

You Know Advisory Is the Future. Here's the System to Deliver It.

After running a virtual CFO practice, acquiring and growing a bookkeeping firm, and conducting hundreds of client meetings, we documented exactly why most firms fail to engage clients on advisory—and what actually works instead.

That's what Baifokal was built around. But first, here's what we learned.

Works with QuickBooks Online & Xero

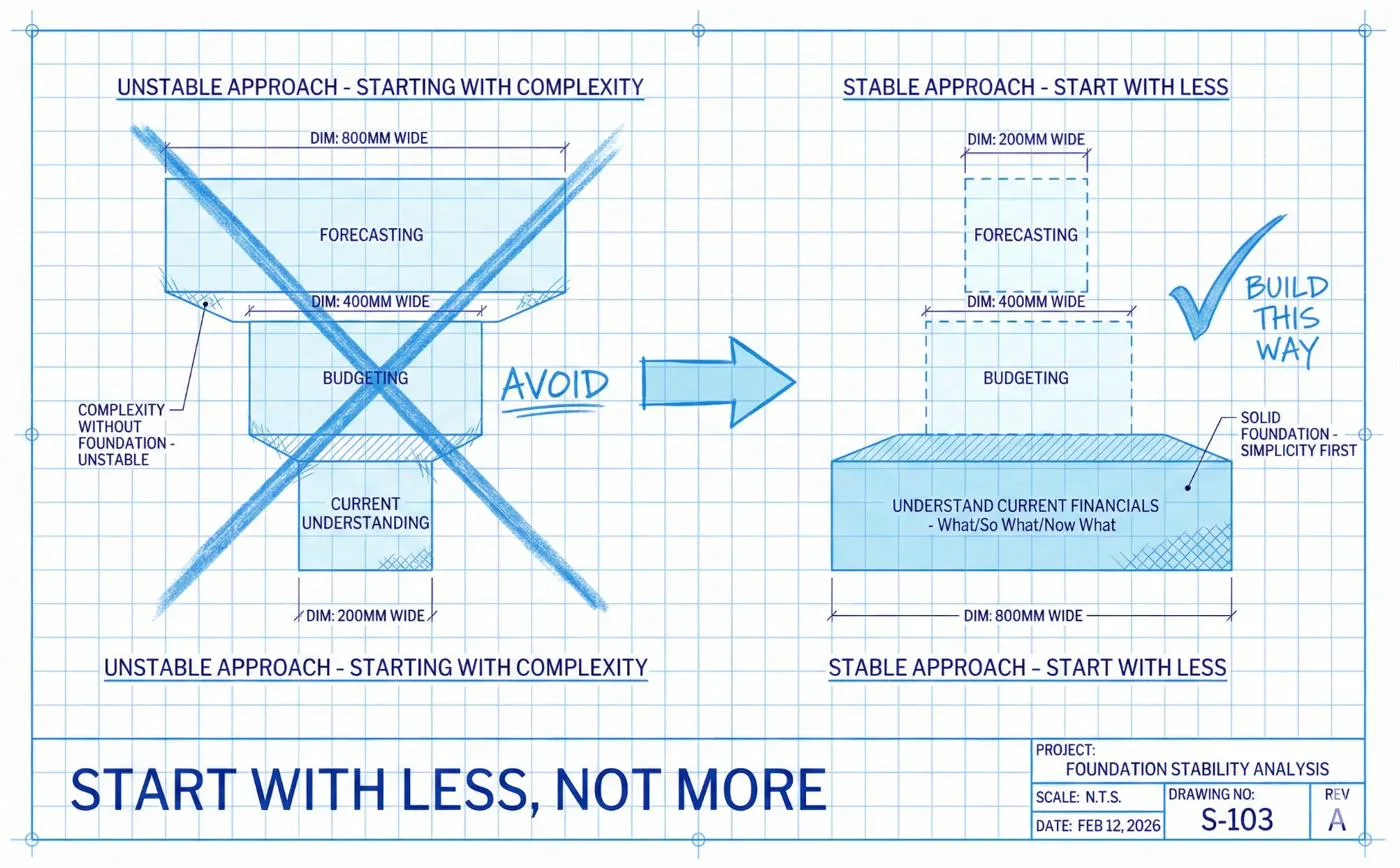

Advisory Starts With Less, Not More

The platforms tell you the answer is forecasting, budgeting, and scenario planning. Here's what we learned the hard way:

Advisory doesn't start with complexity. It starts with clarity. Help clients understand what happened this month, why it matters, and what to focus on next.

Once they trust you to translate complexity into clarity, forecasting and budgeting follow naturally. But only after the foundation is solid.

So what does that foundation actually look like?

What / So What / Now What

The foundation is a narrative structure that turns data into a conversation clients engage with. This is the one we developed—and the one Baifokal is built around:

What happened?

High-level summary. Revenue, margins, the 2–3 metrics that matter most. Here's the headline.

So what does it mean?

Interpretation. A 40% spike in marketing spend isn't just a number—it means customer acquisition cost changed. Facts connected to business impact.

Now what do we do?

Recommendations on a 30, 60, and 90-day basis. Not 15 action items. Two or three things that matter most, with a timeline for results.

You can apply this tomorrow. Manually. In a spreadsheet. The framework is yours.

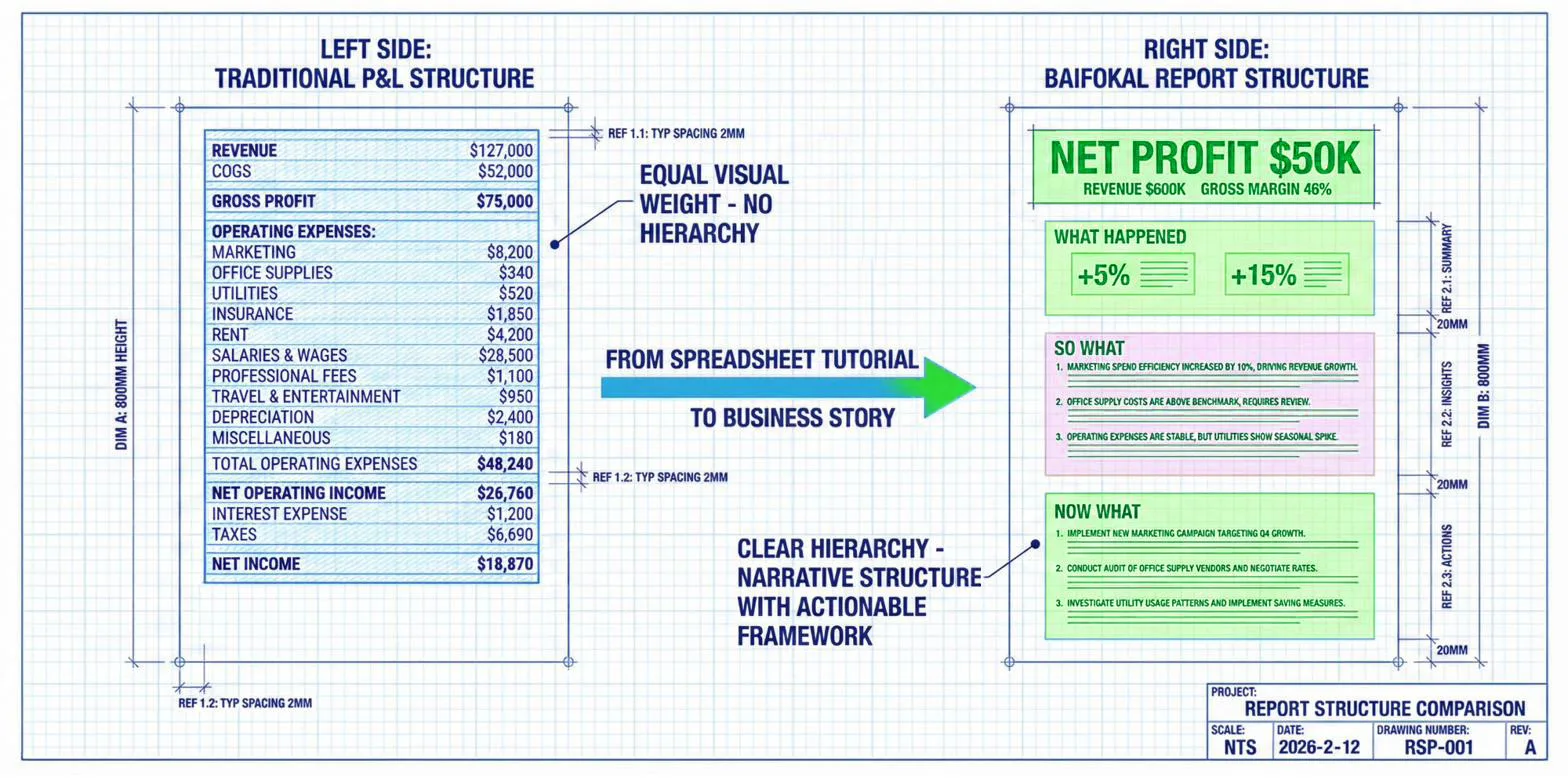

Most financial deliverables fail because of structure, not data. Every line item gets equal weight. No overview, no interpretation, no direction. What / So What / Now What replaces that with a structure clients can act on.

This structure handles individual client engagements. But advisory is bigger than any single month.

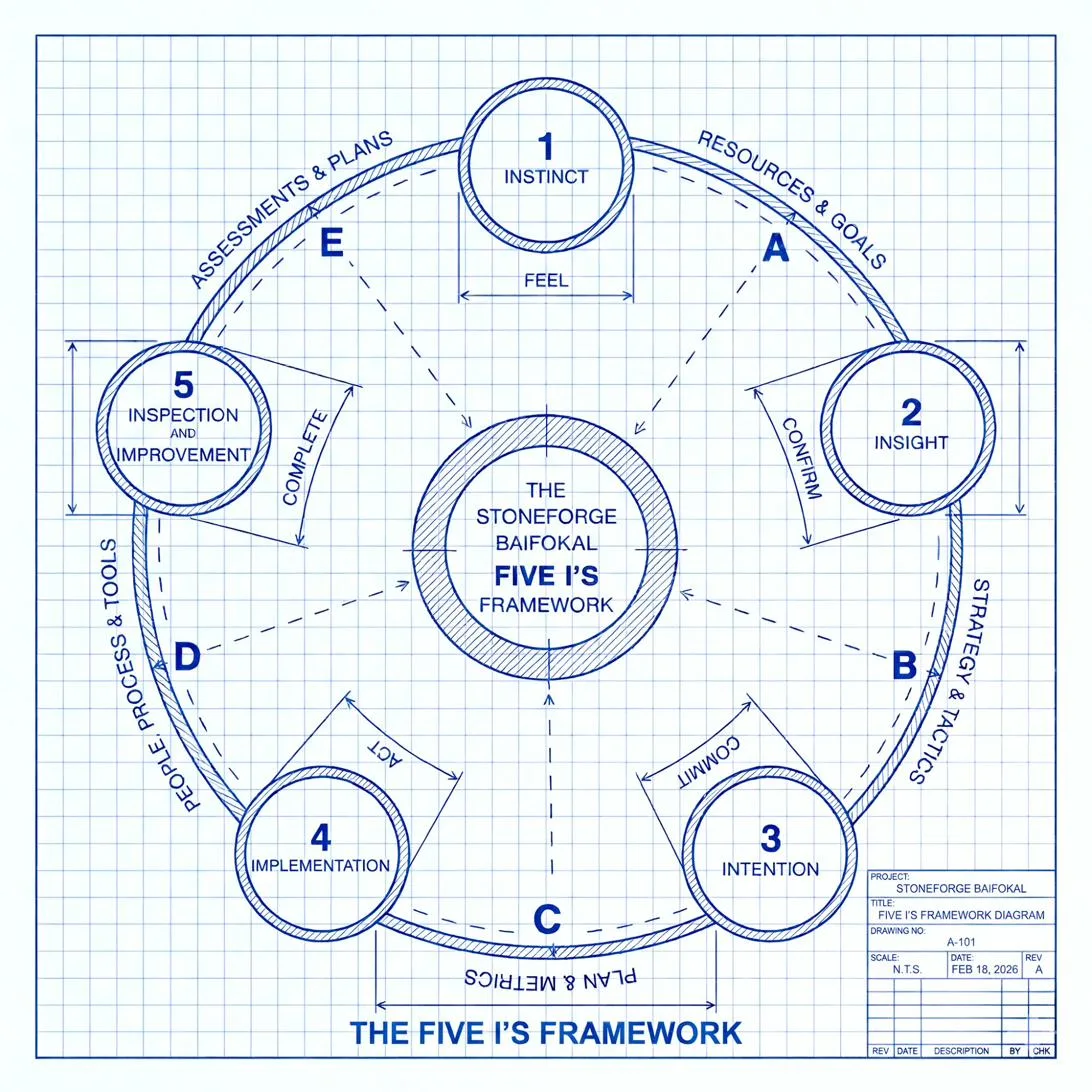

The Five I's: From Clarity to Action

We found a repeating cycle in our most successful client relationships—five stages that every good business decision flows through.

Instinct

Every decision starts with a feeling. Business owners usually have good instincts. The problem isn't lack of instinct.

"What's your gut telling you?"Insight

Instinct alone is gambling. Insight validates it with data. This is where What/So What/Now What lives—turning numbers into understanding.

"Let's check that against the data."Intention

The Now What surfaces 30/60/90-day recommendations. This becomes the advisory conversation: what's needed to make this real? What external accountability is required? Where does the budget come from?

"Which path, and what does it take?"Implementation

The client acts. Results start appearing in the books. You're the external accountability coach and sounding board—the mirror that keeps them honest about progress.

"We said 60 days. Let's track it."Inspection

Next month's report IS the inspection. Did the expected changes materialize? Baifokal surfaces the results automatically. The cycle closes—and the next one begins.

"Here's what happened. Did it work?"

The clarity of the presentation enables you to be what your client actually needs: an external sounding board, an accountability partner, a mirror for their business. That's advisory. And it's a cycle, not a one-time event.

If you've been nodding along, chances are you already know what comes next.

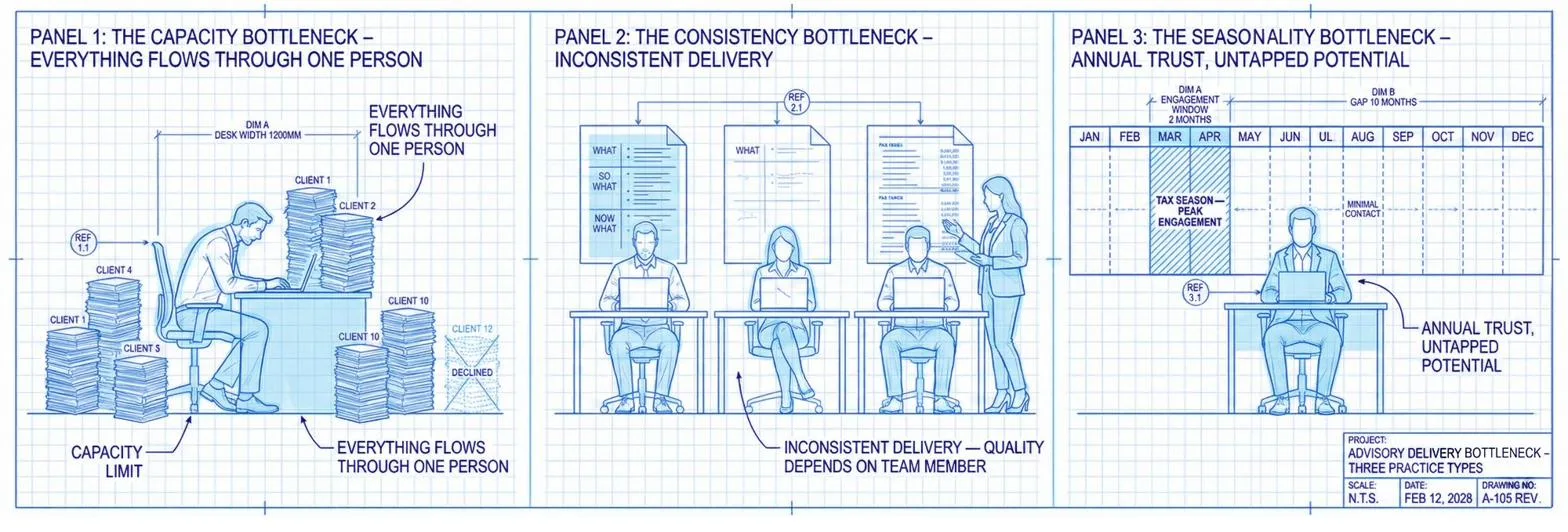

You Know the Problem. You've Lived It.

The advisory delivery bottleneck shows up differently depending on your practice:

"I can't take on another client without dropping quality."

You manage 5–15 clients. Six to eight hours per client on mechanical work alone. You've turned down new business because the capacity isn't there.

"My team does great compliance work. Advisory is a different skill set."

Advisory-level output requires narrative structure your team wasn't trained for. You can't personally review every client deliverable.

"Monthly engagement would transform my tax practice."

Annual engagements could become monthly advisory relationships. The question isn't whether it's valuable. It's how to deliver it at scale.

Different practices. Same bottleneck.

So what's actually in the way?

The Capacity Problem and the Delivery Gap

Stage 2 is eating all your time.

Pulling data from QuickBooks. Calculating variances. Formatting outputs. Reconciling discrepancies. Six to eight hours per client per month—consumed before you ever get to the work clients actually value.

The client gets a data dump. They don't get clarity.

Mechanical WorkWhat a computer should do

Extracting data from QuickBooks or Xero

Calculating variances across every P&L category

Comparing to prior months, trailing averages, and same-month-last-year

Identifying anomalies and material changes

Drafting narrative explanations of what changed

Formatting deliverables with graphs and indicators

Flagging uncategorized or unreconciled items

Fact-based, repeatable, rule-driven.

Judgment WorkWhat only you can do

Deciding if 7.6% growth is good for this business

Knowing whether a marketing spike was planned

Recognizing if a trend aligns with client strategy

Adding the context that makes insights actionable

Being the accountability partner who tracks follow-through

Facilitating the conversation that drives decisions

Context, relationships, professional judgment.

And delivery is a different skill from analysis.

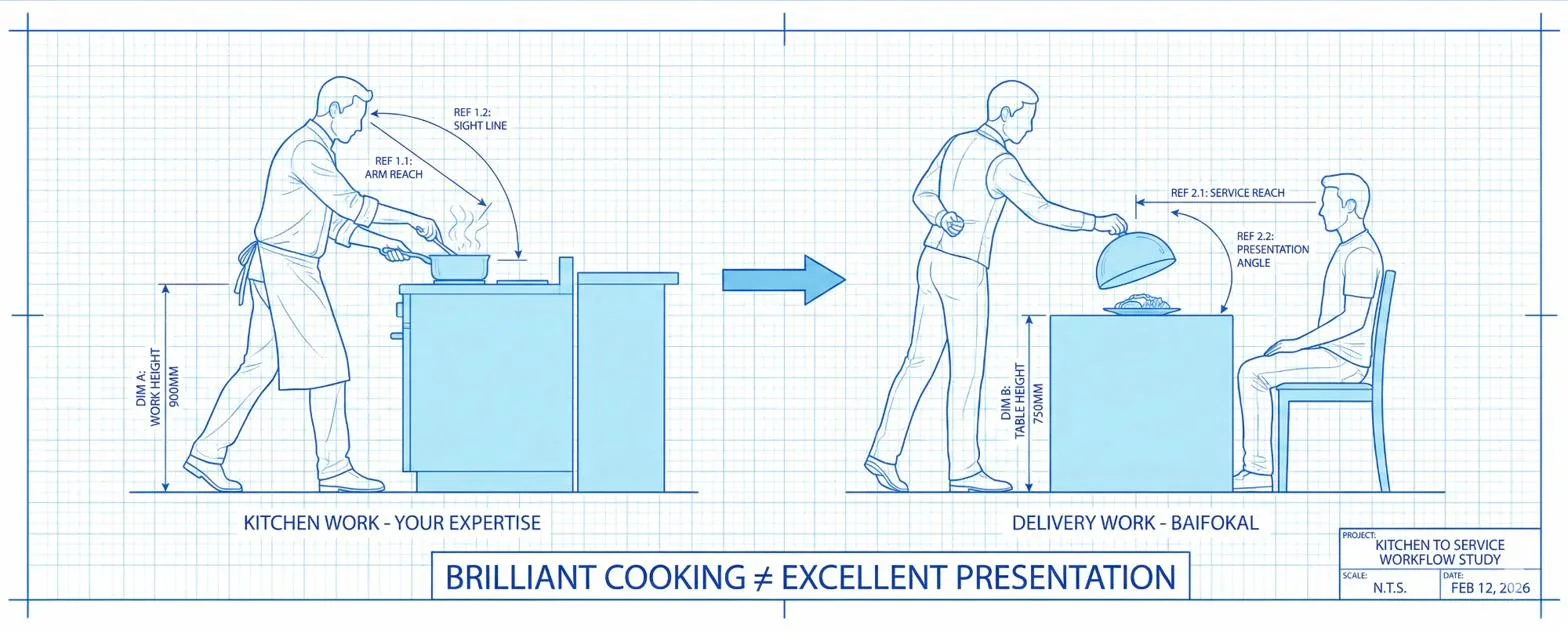

You know the data. You understand the business. You can spot what matters. That's the kitchen—and you're an excellent chef.

But translating that expertise into structured narratives, plain-English explanations, and consistent deliverables? That's front-of-house. A different skill set entirely. A Michelin-starred chef can be undone by bad service—and brilliant analysis can be undone by dense delivery.

The problem isn't talent. It's that no one built the front-of-house for financial advisory. The standard monthly reports—from QuickBooks, Xero, or bolt-on tools—are P&L exports with a few graphs or AI-generated comments bolted on. No focus. No context. No weighting of what actually matters. At worst, they're PDF'd spreadsheets. The tools stop at the kitchen door.

Kitchen work (your expertise) vs. delivery work (Baifokal)

This Is Baifokal

A secure, web-based monthly financial analysis, narration, and presentation system. It sits between your accounting platform and your client—automating the mechanical work and structuring the delivery so you can focus on judgment, context, and relationship.

The Baifokal Workflow

Most software gives you a blank canvas. Build your own dashboards. Choose your own templates. Spend weeks figuring out what works.

Baifokal is deliberately prescriptive. We spent a decade figuring out which metrics to lead with, how to structure the narrative, what comparison periods matter, how to badge changes so clients see significance instantly. All of it is built in. Proven across hundreds of client relationships.

Here's what happens when you run a client through the system:

Connect your accounting platform.

QuickBooks Online or Xero. Direct integration, automatic data sync. No exports, no spreadsheets. You set it up once.

Pre-flight validates your data.

Uncategorized transactions. Unreconciled accounts. Duplicates. Inconsistencies. Baifokal catches problems before your client sees a number. This alone saves hours of embarrassment and rework.

Deterministic analysis finds what matters.

Hand-coded algorithms analyze P&L across all major categories, plus bank balances and AR. Performance measured against industry-aware rules of thumb using NAICS classifications and company demographics.

Constrained AI turns analysis into plain English.

Precise, tightly constrained prompts grounded in verified facts. AI doesn't hallucinate the story—it translates what the algorithms found into language your client understands.

You're the professional in the loop.

Add client-specific context—your knowledge of this business, this owner, this quarter. Your adjustments feed back into Baifokal's continuous learning engine. Next month is smarter than this month.

Clients see their business clearly.

Secure, read-only access. No accounting credentials. No training. They open a link and understand their business. Or you export a PDF on demand.

And because the Now What includes 30/60/90-day recommendations, next month's report becomes the inspection: did the expected changes materialize? The Five I's cycle closes automatically. You stay in the conversation—as the external accountability partner your client needs.

What the Client Actually Receives

Every month, Baifokal produces a complete advisory deliverable with four components:

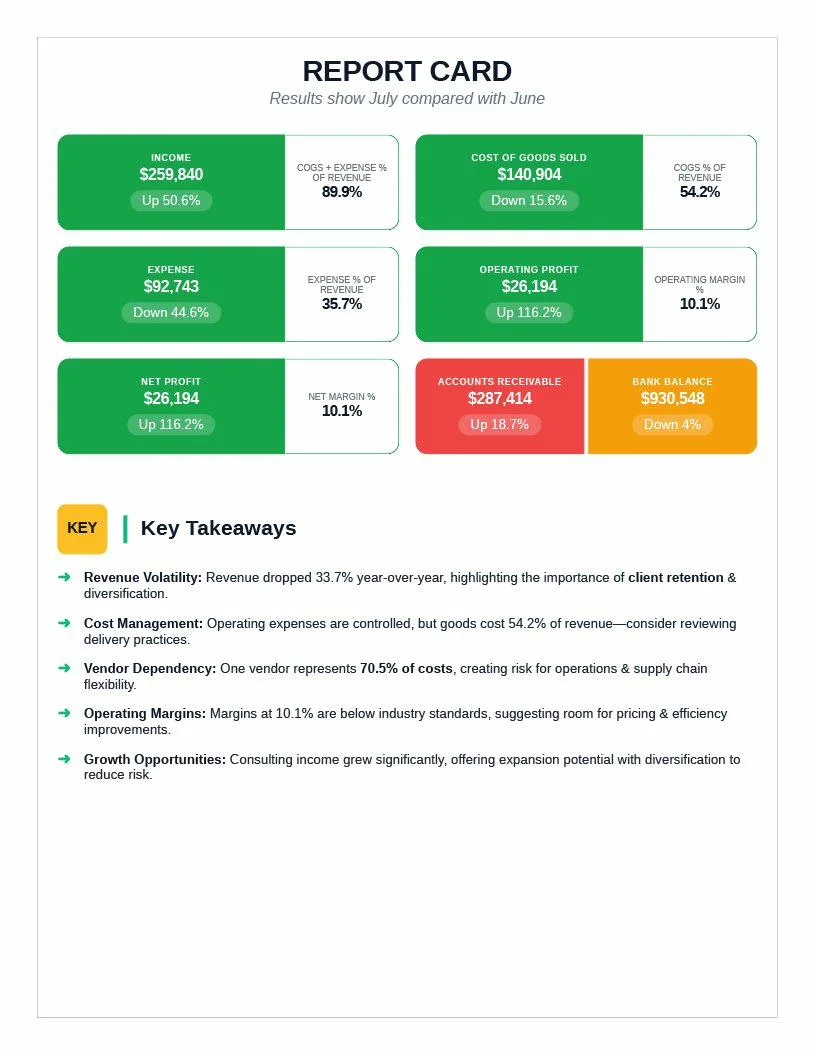

The Report Card

Your business on a page. Key metrics at a glance. Key takeaways, surfaced automatically. Your client opens this and immediately understands how their business performed—before reading a single paragraph.

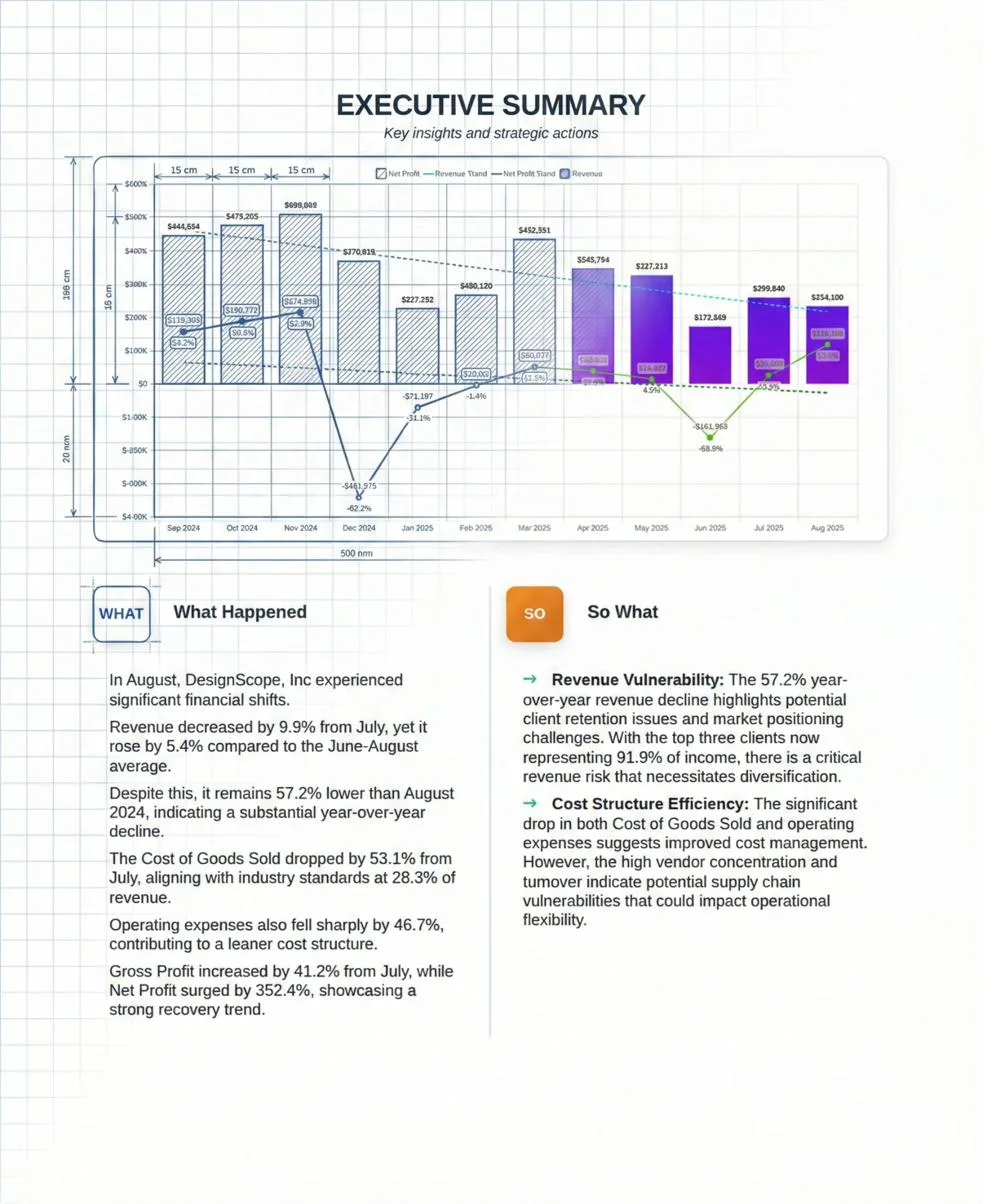

The Executive Summary

The core of the deliverable. The overall business narrative structured as What happened / So what / Now what, with substantive key takeaways for each area and 30/60/90-day recommendations.

Area Overviews

Detailed analysis on Revenue, Cost of Goods Sold, Expenses, Profit—plus Other Income/Expenses when relevant. Smart comparison graphs: this month vs. last, trailing three-month trend, YTD vs. last YTD, same month last year. Clear KPI indicators show direction, not just numbers.

Smart Appendices

Automated appendices identify major changes across the business. Each badged: major spike, minor spike, major drop, minor drop, or new substantive item. Your client sees what moved and how much it matters—without digging through line items.

Engineered. Not Templated.

Templates assume similarity. Every client gets the same sentence with blanks filled in. That’s not advisory—that’s mail merge.

Baifokal’s output is dynamically generated from hand-coded, deterministic algorithms. Every variance is mathematically certain. Every comparison is calculated against NAICS-aware industry benchmarks. Every narrative is built from verified facts—not pattern-guessed by a language model.

The architecture is deliberate: deterministic analysis extracts what matters. Constrained AI translates those verified facts into plain English. Facts first. Narrative second. The math is always exact. If the algorithm says revenue increased 12%, it increased 12%. No hallucination. No probabilistic guessing. No “this looks right based on patterns I’ve seen.”

This is what it looks like under the hood:

Every dimension is intentional. The chart isn’t decoration—it’s a twelve-month revenue and profit trend with variance calculations at every data point. The narrative sections aren’t boilerplate—they’re generated from the specific variances, patterns, and anomalies the algorithms found in this client’s data, this month.

$79 Per Client. Per Month.

The mechanical work in Stage 2—extracting data, calculating variances, identifying anomalies, drafting narrative, formatting the deliverable—takes six to eight hours per client per month.

You have two realistic options for handling that work. You can keep doing it yourself—but those are your most expensive hours, and it doesn't scale. Or:

Hire a Junior Analyst

at 10 clients

Baifokal

Advisory delivery powered by Baifokal is chargeable. A structured monthly advisory meeting with your client—grounded in a professional deliverable they can see and act on—commands $250–$350+ per month. Follow-on advisory conversations, strategic planning, and accountability coaching drive further revenue on top.

At $79 per client, you’re looking at 3–4x return on every dollar spent—before accounting for the deeper engagement, stronger client loyalty, and reduced churn that monthly advisory creates.

This isn’t an expense line. It’s the foundation of a more profitable practice.

Built By People Who've Lived This Work

James & Kristina Walls — Co-Founders

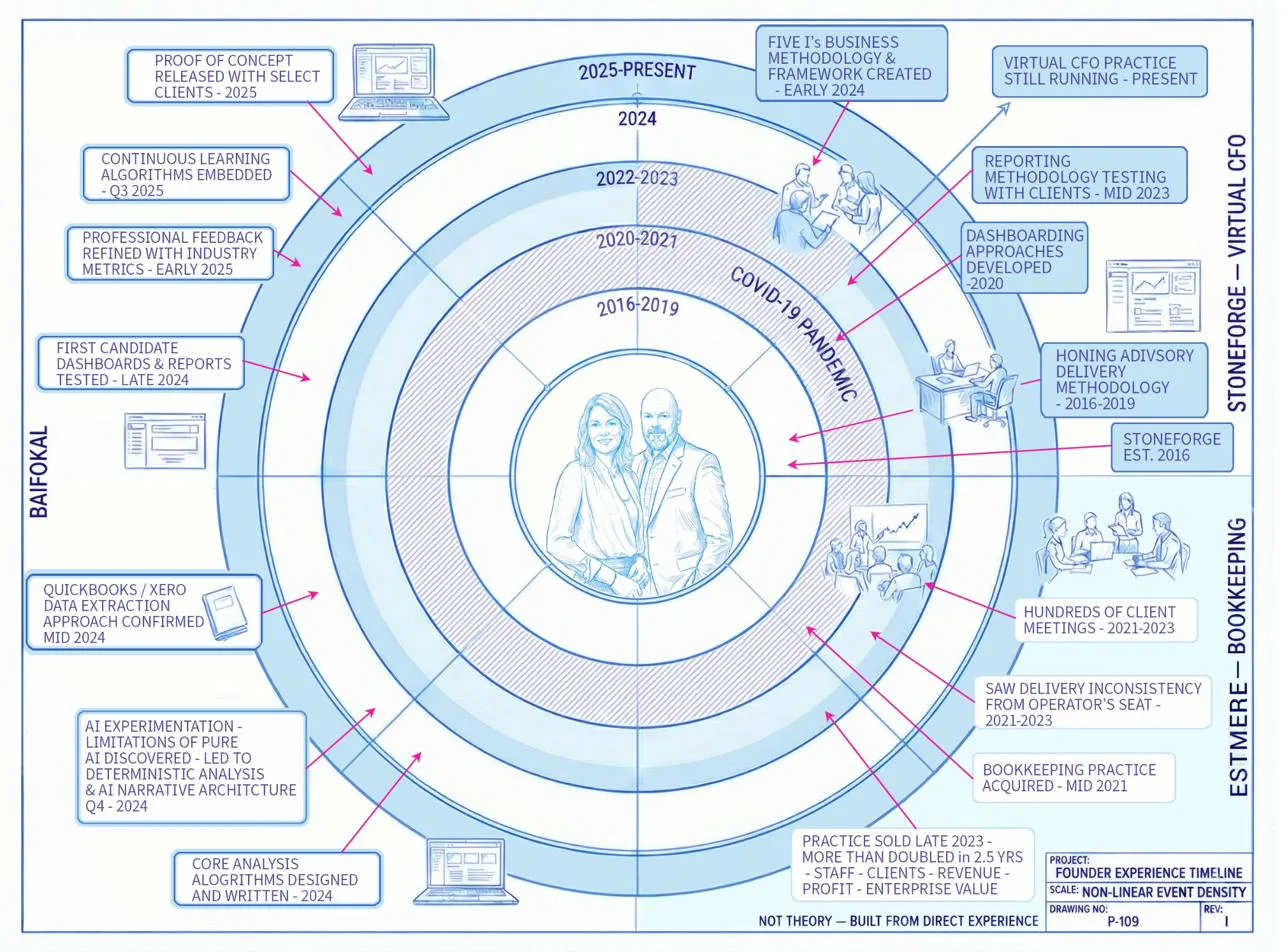

We started in 2016 with a virtual CFO business. That's where we discovered the Five I's—by documenting how our most successful client relationships actually worked.

In 2021 we acquired a bookkeeping practice. Hundreds of client meetings. We watched teams walk through every P&L line item while clients mentally checked out. That's where we learned the delivery gap.

We more than doubled the practice in 2.5 years and sold it in late 2023. By then we knew exactly what the system needed to do. Baifokal is that system.

Frequently Asked Questions

You've Seen the Frameworks.

Experience the System.

Monthly advisory delivery. Automated analysis. Plain-English narrative from constrained AI. Industry-aware context. Continuous learning. Client-ready output in minutes.

$79 per client per month.

Join the Waitlist

Priority onboarding. Founding member pricing, locked in. Direct input on feature development.

Join the WaitlistSchedule a Demo

See Baifokal in action. Walk through a real client deliverable with us.

Schedule a DemoGet the Newsletter

Monthly advisory delivery strategies. Frameworks, case studies, practical insights.

Subscribe

The Opportunity Behind Baifokal

There are approximately 200,000 accounting and bookkeeping firms in the US that could deliver monthly advisory services—but lack the infrastructure to do so at scale.

Baifokal is building that infrastructure: a vertical SaaS platform with recurring revenue, high retention, and a product that gets more valuable with every month of use.

If you're interested in learning more, we'd welcome the conversation.